Frequently Asked Questions

General questions about our company, service, and properties we offer on this website.

What does Owner Financing actually mean?

Owner financing happens when a property buyer purchases a home directly from the seller without relying on a traditional mortgage lender. This is a great option for buyers who may not qualify for conventional financing.

We’ve helped many people like you achieve homeownership through our Plano owner financing program.

Fill out the form below to get started on your path to owning a home!

What is the Owner Financing process?

The process is simple!

- Find a Home—Once you’ve found a property you love, we’ll send you an application.

- Application & Verification – We work with people in all types of financial situations. If you can afford the home, we’ll do our best to help you own it. You’ll need a down payment and a verified household income to ensure you can comfortably make the monthly payments.

- No Bank Hassles – With owner financing, you can skip the strict bank qualifications and move toward homeownership faster. Our company‘s process helps protect you by ensuring the home is affordable for your budget.

That’s it!

The first step? Sign up to browse available properties in Plano. Simply fill out the form below to get instant access to great homes and more.

What if I have bad credit? Can I still get a home with Owner Financing?

Yes! Many people with bad credit can still purchase a home without relying on a bank.

Every situation is unique, but we specialize in helping individuals who have faced challenges—or made past financial mistakes—get back on track toward homeownership and a stronger financial future.

Fill out the form below to take the first step toward owning your home!

What are the benefits of Owner Financing?

Owner financing offers many great benefits!

In the Plano area, many savvy buyers use owner financing to purchase their dream home without the hassle of qualifying for a bank loan. Plus, it helps you save thousands on closing costs and lender fees typically associated with traditional mortgages.

In recent years, banks have tightened their lending requirements, making it harder to secure financing through traditional means.

Know how the process works! Get started now by filling out the form at the bottom of this page.

Is there a required down payment?

Yes, but we can be very flexible.

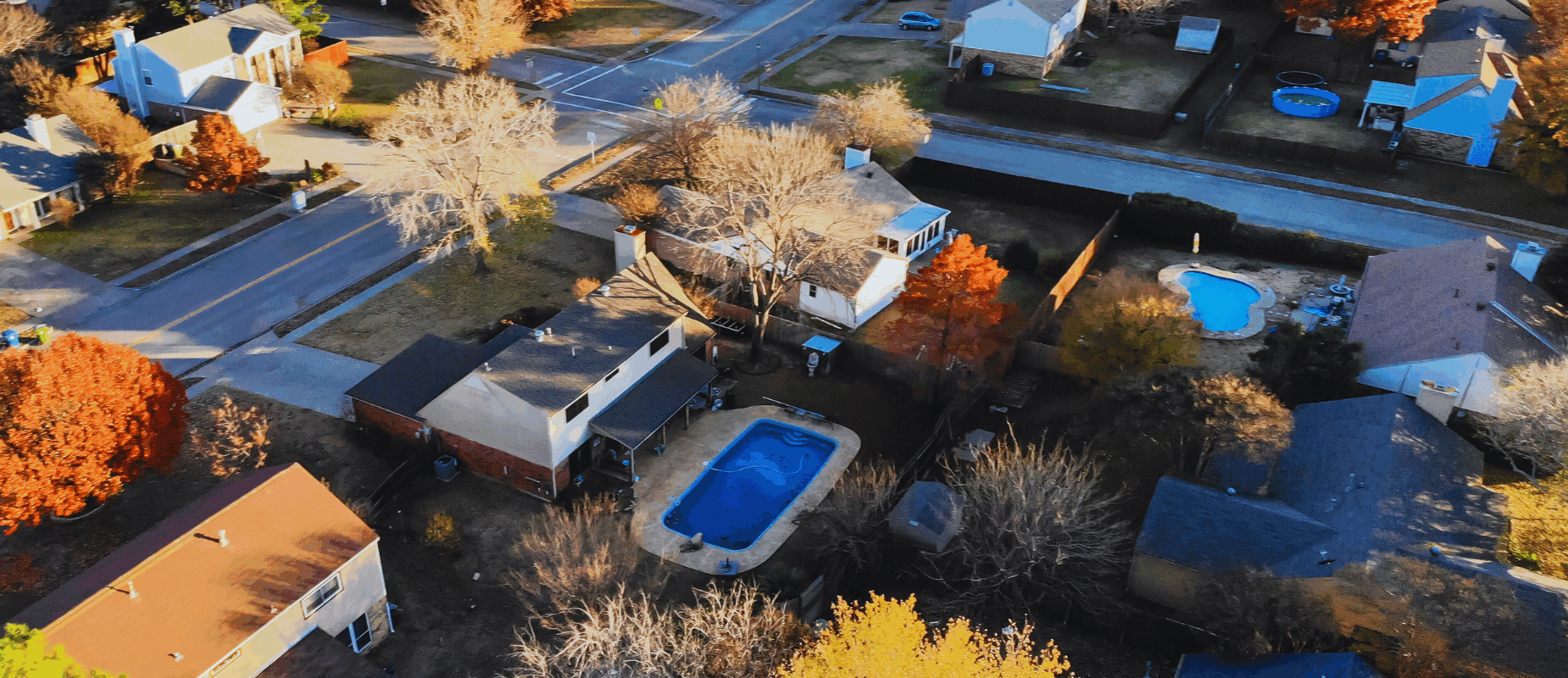

Our Plano homes range in price from $49,900 to $89,900 and typically require a down payment of $3,000 to $10,000. We have found that this is the best price range to find homes that are in decent neighborhoods where people want to own a home and raise a family.

So don’t wait! Get started now by filling out the form at the bottom of this page.

What are the requirements of an owner-financing arrangement?

We understand that every person, family, and situation is unique.

Our goal is to help you find creative solutions to make homeownership a reality.

After viewing the home, you’ll complete an application with details about everyone living there.

We’ll conduct a credit check and verify the income of all household members over 18 to ensure the monthly payment is manageable.

Additionally, we’ll speak with your references and previous landlords because we value relationships beyond just credit scores.

We love helping great folks reach their dreams, so contact us. Let’s discuss this!

Frequently Asked Questions About Owner Financing in Dallas Homes

What is owner financing on properties and how does it work?

Owner financing (also called seller financing) means the property or house seller becomes your lender instead of a bank. You’ll make monthly payments directly to us and you build equity with each payment. You’ll receive a deed to the property once the terms are fulfilled. It’s real homeownership without bank involvement.

What credit score do I need for owner financing on a house?

Unlike banks in Dallas TX that require 620+ credit scores, we look at your complete financial status. We’ve approved buyers with scores in the 500s and even those with no established credit when other factors are positive. We focus more on your current income stability and ability to make the monthly payments.

How much down payment is typically required?

Our down payments typically range from $3,000 to $10,000 depending on the property and your situation. This is significantly less than the 10-20% down payment traditional lenders require, which can be $30,000+ on even modestly priced homes.

Are owner-financed homes more expensive?

While interest rates may be slightly higher than current bank rates, the total cost of ownership is often lower when you consider the savings on mortgage insurance and other fees. Plus, the ability to buy now rather than wait years to repair credit can save you thousands in rent payments. At Cima Real Estate, we structure our financing to be fair and transparent.

What are the typical terms for owner financing?

Our standard terms range from 15-30 years with fixed interest rates. This means predictable payments throughout your loan. We structure payments to be comparable to what you’d pay in rent for a similar property, so your transition from renting to owning is seamless.

Can I refinance an owner-financed home later?

Absolutely! Many of our buyers improve their credit situation over time and eventually refinance with a traditional lender to secure a lower interest rate. We structure our agreements to make this transition smooth when you’re ready.

Do I own the home with owner financing?

Yes! Owner financing creates real homeownership. You’ll typically receive either a deed with a lien (just like a bank mortgage). But you can also use a contract for a deed that transfers ownership of a property or land for sale upon completion of payments. Both methods provide legal protections for your investment.

How do taxes and insurance work with owner financing?

Just like any homeowner, you’ll be responsible for property taxes and homeowner’s insurance. We can help by escrowing these payments (including them in your monthly payment) so you don’t have to worry about large annual bills. This helps you budget more effectively.

Enter Your Information Below To Get Immediate Access

… to our Owner Financing specials. *These are not found anywhere else!*